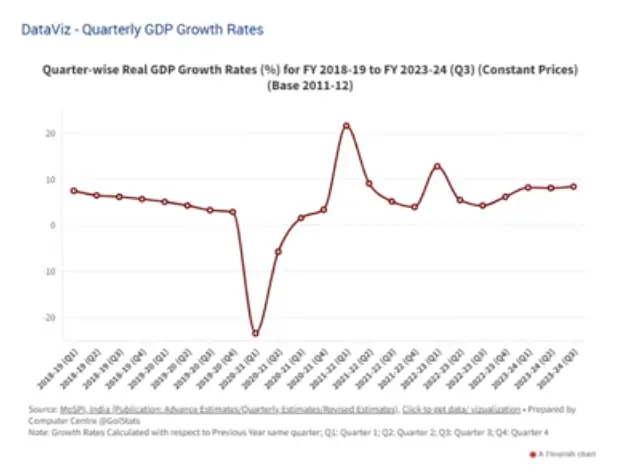

A global depression is an example of widespread economic inertia usually characterized by dropping GDPs, growing unemployed population and trade reduction. It is entirely incompatible with the case of India’s 8.4% GDP growth which demonstrates its resilience during recessions. A world ever changing Recession is defined as two consecutive quarters of negative economic growth, which results in a slow rate of output, increasing unemployment and generally a contraction of business activity. This has been seen in various parts of the world leading to weak economies and great suffering among the citizens. India’s GDP grew impressively at 8.4% during Q3 (third quarter) fiscal year 2024 compared with 4.3% registered last year during same period. Exceeding Predictions This growth rate was higher than that predicted by most economists thereby revealing the unexpected strength of Indian economy.

“Trouble in the World Economy: UK and Japan Hit by Recession”

India’s Economy show continuous growth compared to many other countries facing economic challenges. This makes India an important player in the world economy. Because India is growing so strongly, it’s becoming a great place for other countries to invest money, making its future even brighter. While the other hand UK and Japan slipped into recession because energy prices shot up, and there were problems getting stuff from one place to another, prices for things went way up in Japan and the UK, That meant people purchasing power has decline and it slowed down how much money they were spending. To tackle this issue, the banks in both countries made it more expensive to borrow money by raising interest rates. This, in turn, made businesses and people think twice about investing or buying things.

In the UK, they had extra problems because of issues tied to Brexit and a bit of uncertainty in politics. Over in Japan, they were dealing with challenges like having more older folks and fewer people working, While it’s not great that the UK and Japan are going through tough economic times, the Eurozone managed to avoid a similar situation by a narrow margin. Also, there’s some hope that prices might not be going up as fast in some parts of the world.

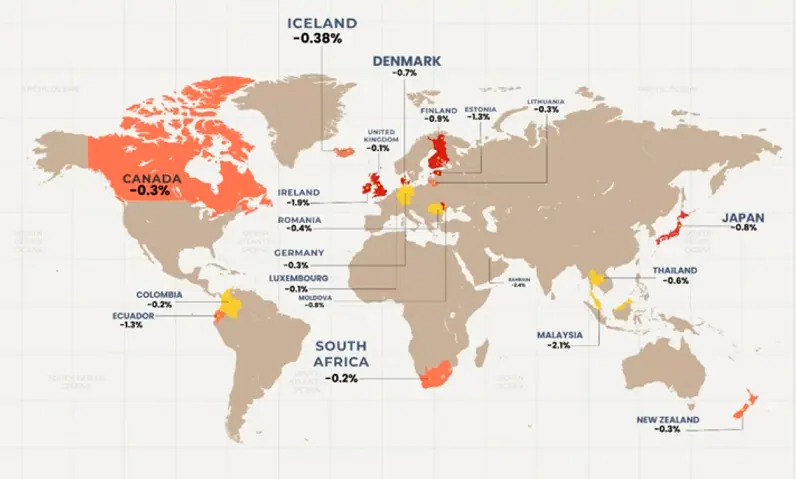

“Global Economic Concerns: The UK and Japan Are Just the Tip of the Iceberg, with 18 Other Countries Nearing Recession”

UK and Japan economic challenges are in the front papers due to their sizes. But, we must bear in mind that many other countries may experience similar if not worse recession risks. For instance, Finland, Ireland, Sweden, the Netherlands and even major players like Germany have been marked as likely candidates by default to fall into a recession. Among these concerns there is some indication that inflation might be easing in certain quarters; however, the relentless upward movement of prices continues to threaten people’s ability to buy things. The ongoing world conflict also makes it more complicated through disruption of energy markets and supply chains which impact international trade as well as overall economic growth. Furthermore, the central banks’ policy of raising interest rates with an eye on inflation may inadvertently slow down economies too much. It is this fragile balance amidst multiple challenges that underscores the complexity and interdependence of the global economic landscape.

Japan has just slipped to become the world’s fourth-largest economy, now trailing behind the US, China, and Germany in terms of nominal GDP. One of the reasons for this change is the significant drop in the value of the Japanese yen against the US dollar. Because we measure GDP in dollars, when the yen is weaker, it makes Japan’s economic output seem smaller. Unfortunately, Japan’s economy has been growing more slowly than other big economies for a while now.

Barclays’ revised GDP forecast for India, the reasons behind it

India is forecasted to grow by 7.8% GDP in the fiscal year 2024, according to Barclays, which has made recent improvements in its economic prospects. Barclays’ new look at India’s economy reflects its attitude toward the nation’s ability for resilience amidst all other worldwide uncertainties. People claim that it was unexpected jump in India’s Q3 GDP that might have caused this shift because it showed a resilient Indian economy despite global headwinds.

In this scenario, however, Barclays sees optimism for the Indian economy owing to such factors as resilient Indian economy despite global vagaries, a strong domestic market with immense purchasing power, various initiatives on “Make in India” to promote local manufacturing industry and state policies including substantial infrastructure investment by government.The meaning of future predictions therefore points to an increased investor confidence as well as positioning India among the growing economies globally.But still an optimistic perspective from Barclays would mean that there are underlying problems that could be addressed by India especially on inclusive growth.Least we forget inflationary pressures must also be managed effectively during such times (inflation targeting).

Also Read- India’s Stock Market Outlook: A 9% Rise Anticipated in 2024, According to Recent Poll