Hindustan Aeronautics Limited (HAL) Share growth 2024, market price, investment, returns, financial markets, HAL Share Historical Yearly Growth and Analysis, HAL Best Stocks to Invest in India 2024.

Hindustan Aeronautics Limited (HAL) is among the biggest aerospace and defense companies in Asia. It is a state-owned enterprise under the Ministry of Defence. HAL designs, develops, manufactures, and maintains a wide range of aircraft, helicopters, and other aerospace products for the Indian Air Force, Indian Navy, Indian Army, and other defence forces.

HAL was founded in 1940 during World War II to meet the urgent need for aircraft for the Indian Air Force. The company has since grown to become one of the leading aerospace companies in the world. HAL’s products are used by armed forces in over 50 countries.

HAL’s key products and services include:

- Aircraft: Hawk, Tejas, Chetak, Dauphin, ALH

- Helicopters: Dhruv, Cheetah, Rudra, Mi-17

- Engines: HF25, HTFE731, GTRE400

- Avionics: Flight control systems, navigation systems, radar systems

- Missiles: Astra, Nag, Trishul

- Simulators: Flight simulators, helicopter simulators

Hindustan Aeronautics Limited (HAL) Growth and Analysis:

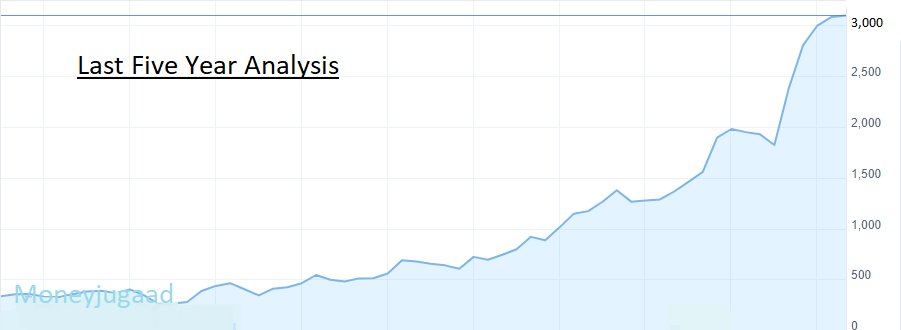

Over the last five years, HAL’s revenue hasn’t shown remarkable growth, with an average yearly increase of about 7.77%. However, the company’s profit has fared better, experiencing a more significant growth rate of around 23.94% per year on average during the same period. This suggests that while HAL’s sales haven’t surged dramatically, its profitability has shown a positive trend, indicating effective management and potentially improved operational efficiency over time.

Most analysts have a “Buy” or “Strong Buy” rating on HAL’s shares. They believe that the company has the potential to continue to grow in the coming years, driven by the increasing demand for aerospace and defence products.

Also Read- “A Decade of Dynamic Growth: Reliance Industries’ Key Milestones (2010-2023)”

HAL’s share price has grown steadily over the past few years, and is expected to continue to grow in the coming years. The company is well-positioned to benefit from the growing demand for aerospace and defence products in India and abroad.

Hindustan Aeronautics Limited (HAL) Share Price expected growth in upcoming five years:

Analysts are generally bullish on HAL’s share price outlook in the upcoming five years. They believe that the stock has the potential to grow at a CAGR of 10-15% over the next five years.

Here are some specific analyst’s targets for HAL’s share price in the upcoming five years:

- InCred Equities: ₹5,000 by 2025 InCred Equities, a financial analysis firm, projects HAL’s share price to reach ₹5,000 by the year 2025. This forecast likely stems from their analysis of HAL’s historical performance, market trends, and potential future growth factors. Analysts at InCred Equities may have considered various aspects such as the company’s financial health, industry trends, upcoming projects, and macroeconomic factors to arrive at this target price.

- Morgan Stanley: ₹5,500 by 2025 Morgan Stanley, a renowned global financial services firm, predicts HAL’s share price to reach ₹5,500 by 2025. Morgan Stanley analysts are likely factoring in a range of variables, including market dynamics, global economic conditions, industry-specific data, and HAL’s strategic initiatives. Their optimistic target could be influenced by a positive outlook on HAL’s business prospects, innovations, or potential contracts in the aerospace and defense sectors.

- Credit Suisse: ₹6,000 by 2025 Credit Suisse, another major financial institution, forecasts HAL’s share price to rise to ₹6,000 by 2025. Credit Suisse analysts likely conducted a comprehensive analysis of HAL’s financial statements, market position, competitive advantages, and geopolitical factors.

Hindustan Aeronautics Limited (HAL) Share Price Prediction 2025

| Year 2025 | Hindustan Aeronautics Limited (HAL) Stock Price Prediction 2025 ₹ 6000 |

Hindustan Aeronautics Limited (HAL) Share Price Prediction 2030

| Year 2030 | Hindustan Aeronautics Limited (HAL) Stock Price Prediction 2030 ₹ 7000 |

Hindustan Aeronautics Limited (HAL) Share Price Prediction 2040

| Year 2040 | Hindustan Aeronautics Limited (HAL) Stock Price Prediction 2040 ₹ 9000 |

Hindustan Aeronautics Limited (HAL) Share Price Prediction 2050

| Year 2050 | Hindustan Aeronautics Limited (HAL) Stock Price Prediction 2050 ₹ 10,000 |

Also Read- Adani Green Energy Share Price target 2023,2025,2030,2040 and 2050

Top Investors in HAL:

Hindustan Aeronautics Limited (HAL) has its ownership distributed among various investor groups:

Foreign Institutional Investors (FIIs): 71.64%

- Foreign Institutional Investors, representing international investment firms, own the majority share at 71.64%. This indicates significant confidence from global financial organizations in HAL’s performance and potential.

Mutual Funds: 11.90%

- Mutual funds hold 11.90% of HAL’s shares. These are investment vehicles managed by professionals, indicating that a considerable portion of HAL’s ownership is in the hands of individual and institutional investors participating in mutual fund schemes.

Other Domestic Institutions: 6.60%

- Domestic institutions, other than mutual funds, own 6.60% of HAL. These could include insurance companies, pension funds, and other non-banking financial institutions based within the country.

Retail Investors: 9.96%

- Retail investors, which include individual investors trading in smaller quantities, hold 9.96% of HAL’s shares. This category represents ordinary people investing in the company, showcasing the interest of the general public in HAL’s stock.

| Investor | Country | Percentage |

|---|---|---|

| BlackRock | USA | 22.11% |

| Fidelity International | UK | 9.56% |

| State Street Corporation | USA | 7.88% |

| Norges Bank Investment Management | Norway | 6.44% |

| Capital Group | USA | 5.77% |

Hindustan Aeronautics Limited (HAL) releases his IPO in 2018:

HAL released its IPO in 2018 and is now listed on the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE).

HAL’s IPO was subscribed 13.7 times, making it one of the most successful IPOs in India in recent years. The IPO raised ₹2,760 crore, which was used to fund HAL’s investment in new technologies, expanding international presence, and upgrading existing facilities.

HAL’s listing on the BSE and NSE has made it more accessible to investors and has helped to increase the company’s visibility and credibility. The company is now well-positioned to benefit from the growing demand for aerospace and defence products in India and abroad.

Official Site Of Hindustan Aeronautics Limited (HAL)

Some Frequently Asked Questions:

What is HAL’s primary business focus?

HAL is primarily engaged in the design, development, manufacture, and maintenance of aircraft, helicopters, and aerospace products, serving the Indian Air Force, Indian Navy, Indian Army, and other defense forces.

How has HAL’s share price performed recently?

As of the latest available data, HAL’s share price is ₹1,953. It has shown steady growth in recent months, gaining over 1.68% in the past three months, 42.47% in the past six months, and 66% in the past year.

What are some analyst predictions for HAL’s share price in the upcoming five years?

Analysts have varying projections, with targets such as ₹5,000 by 2025 (InCred Equities), ₹5,500 by 2025 (Morgan Stanley), and ₹6,000 by 2025 (Credit Suisse). These predictions reflect optimism about HAL’s future growth potential.

Who are some of the top investors in HAL?

The top investors in HAL include BlackRock (USA), Fidelity International (UK), State Street Corporation (USA), Norges Bank Investment Management (Norway), and Capital Group (USA).

When did HAL release its IPO, and how successful was it?

HAL released its IPO in 2018, and it was subscribed 13.7 times, making it one of the most successful IPOs in India at that time. It raised ₹2,760 crore, which was used for various investments and expansion plans.