Bajaj Finance growth, market price, investment, returns, financial markets, Bajaj Finance Historical Yearly Growth and Analysis, Bajaj Finance Best Stocks to buy in India 2024, Bajaj Finance best long term stock, Bajaj Finance best stock to invest in India 2024.

Bajaj Finance Limited is a diversified Non-Banking Financial Company (NBFC) in India. It is one of the largest NBFCs in India by assets and market capitalization. Bajaj Finance, a subsidiary of Bajaj Finserv Limited, Established in 1987, headquartered in Pune, Maharashtra, India. The company started its operations as a two-wheeler finance company. Over the years, it has diversified its product portfolio to include consumer finance, commercial finance, rural finance, and wealth management.

Bajaj Finance expected growth in upcoming five years:

Bajaj Finance is projected to experience significant growth over the next five years, with a Compound Annual Growth Rate (CAGR) estimated at a robust 20-25%. In simpler terms, this means that the company is expected to expand steadily at an annual rate of 20% to 25% during this period. This growth forecast suggests that Bajaj Finance is likely to continue its upward trajectory, increasing its business operations, revenue, and profitability at a healthy and consistent pace over the next five years. It reflects the company’s strong potential and positive outlook in the financial industry.

Also Read- Infosys: A Global IT Powerhouse, Technological Growth and Financial Potential

Top Investors in Bajaj Finance:

The top investors in Bajaj Finance are:

- Bajaj Holdings & Investment Limited (34.18%)

- Nirajkumar R. Bajaj (11.19%)

- Jaya Hind Industries Ltd. (3.427%)

- Life Insurance Corporation of India (Investment Portfolio) (3.173%)

- Capital Research and Management Company (2.949%)

- The Vanguard Group, Inc. (2.801%)

- Norges Bank Investment Management (2.753%)

- BlackRock Institutional Trust Company, N.A. (2.743%)

- Goldman Sachs Asset Management, L.P. (2.084%)

- HDFC Mutual Fund (2.055%)

- ICICI Prudential Asset Management Company Limited (1.989%)

These investors hold a combined stake of over 70% in Bajaj Finance. The company’s management team also holds a significant stake in the company. The presence of such well-known and respected investors in Bajaj Finance is a testament to the company’s strong track record of growth and its management team’s execution capabilities.

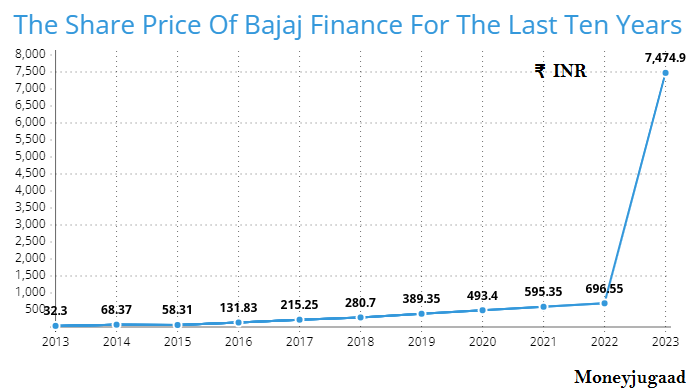

The Share Price Of Bajaj Finance For The Last Ten Years: (2013-2023)

As you can see, the share price of Bajaj Finance has grown significantly over the past 10 years. This is a testament to the company’s strong track record of growth and its potential for future growth.

Bajaj Finance Current Share Price and Company Performance Overview – Read Here

Latest Investment News:

- Bajaj Finance to invest Rs 1,000 crore in digital lending platform: Bajaj Finance plans to invest Rs 1,000 crore in its digital lending platform, Bajaj Finserv MARKETS, over the next three years. The company aims to double the number of loans disbursed through the platform to 20 million per year by 2026.

- Bajaj Finance to acquire minority stake in wealth management firm: Bajaj Finance is in talks to acquire a minority stake in wealth management firm, Prabhudas Lilladher Asset Management Company (PLAMC). The deal is expected to be valued at around Rs 1,000 crore.

Rajeev Jain: Current CEO of Bajaj Finance

Rajeev Jain named one of the best CEOs in India by Fortune magazine: Rajeev Jain was named one of the best CEOs in India by Fortune magazine. He was ranked 22nd on the list. Rajeev Jain is a highly respected leader in the Indian financial services industry. He is known for his innovative approach and his commitment to customer satisfaction. Under his leadership, Bajaj Finance has become one of the most successful NBFCs in India.

Bajaj Finance release his IPO in 1994:

In 1994, Bajaj Finance initiated its Initial Public Offering (IPO), a significant milestone in its history. During this IPO, the company issued 41,75,000 equity shares, each valued at Rs 10, with a premium of Rs 80 per share. Remarkably, the IPO garnered immense investor interest, surpassing expectations by being oversubscribed by 2.6 times.

This IPO marked a resounding success, enabling Bajaj Finance to raise an impressive sum of Rs 343.75 crore. These funds played a pivotal role in the company’s expansion efforts and bolstering its technological infrastructure.

Bajaj Finance’s IPO was one of the first successful IPOs of a non-banking financial company (NBFC) in India. The company’s IPO paved the way for other NBFCs to go public and raise capital from the stock market.

Official Site Of Bajaj Finance

What is Bajaj Finance Limited?

Bajaj Finance Limited is a prominent Non-Banking Financial Company (NBFC) in India. It offers a wide range of financial products and services, including consumer finance, commercial finance, rural finance, and wealth management.

What is Bajaj Finance’s expected growth in the next five years (2023-2028)?

Bajaj Finance is projected to experience steady growth with a Compound Annual Growth Rate (CAGR) estimated at 20-25%. This indicates the company’s potential for continued expansion in the financial sector.

Who is the current CEO of Bajaj Finance?

Rajeev Jain is the current CEO of Bajaj Finance. He is recognized as one of the best CEOs in India by Fortune magazine.