TCS Share growth, market price, investment, stock market, returns, financial markets, best long term stock, Tata Consultancy Services (TCS) Share Price Target and Long-Term Vision 2040.

Tata Consultancy Services (TCS) is a leading global IT services and consulting firm. It was Established in 1968 and its headquarters situated in Mumbai, India. TCS is part of the Tata Group, one of India’s largest conglomerates. With a widespread international presence. It has a vast reach, operating in 150 locations across 50 countries. TCS employs over 600,000 people worldwide, making it one of the largest IT service companies globally. It ranks as the second-largest Indian company by market capitalization and is highly regarded as a valuable IT service brand worldwide, leading the Indian Big Tech sector. In 2015, TCS was recognized as the 64th most innovative company in Forbes’ rankings, underlining its leadership in IT services and the Indian corporate landscape.

K. Krithivasan : Chief Executive Officer and Managing Director of Tata Consultancy Services (TCS)

K. Krithivasan holds the current position of Chief Executive Officer and Managing Director at Tata Consultancy Services (TCS), a renowned global IT solutions and consulting company.

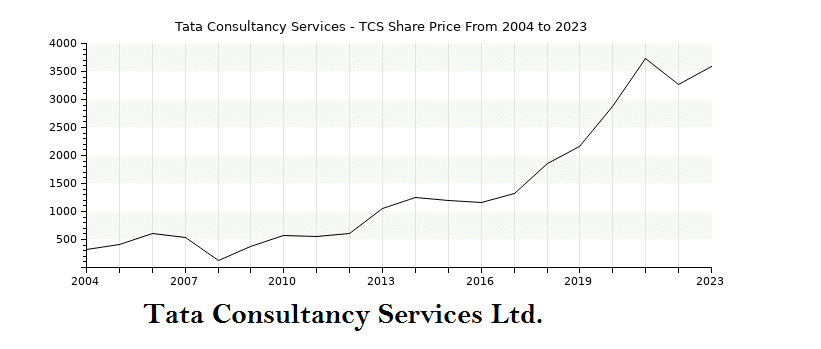

TCS’s Share Price Growth,History and Returns Year by Year:

The chart illustrates TCS’s remarkable share price growth over the years, characterized by a consistent compound annual growth rate (CAGR) of 15%. This upward trajectory is projected to persist as TCS expands its operations and introduces new services. TCS stands out as a competently managed company with a robust history of sustained growth. It ranks among the top-tier IT service brands globally and is primed for ongoing expansion in the foreseeable future.

Tata Consultancy Services (TCS) Current Share Price And Company Performance Overview – Read Here

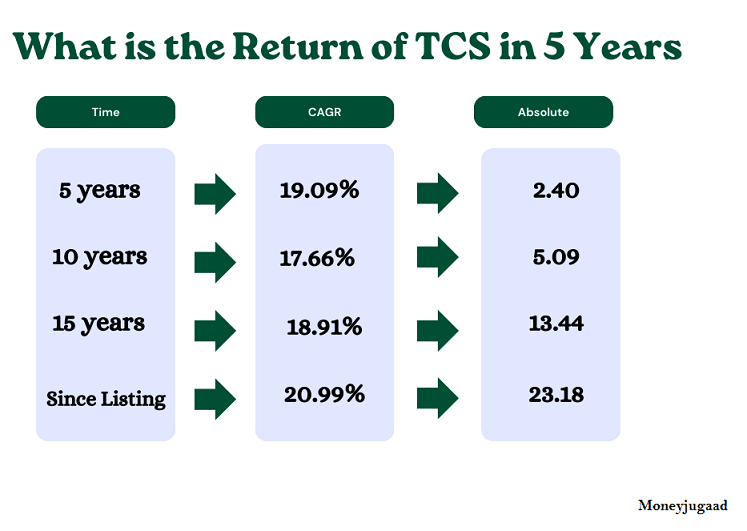

What is the return of TCS in last 5 Years:

Based on historical data and analyst estimates, it is reasonable to expect TCS to generate a positive return over the next 5 years. The company is a well-established leader in the IT industry with a strong track record of growth. It is also well-positioned to benefit from the growing demand for digital transformation services.

What will be TCS share price after 10 years?

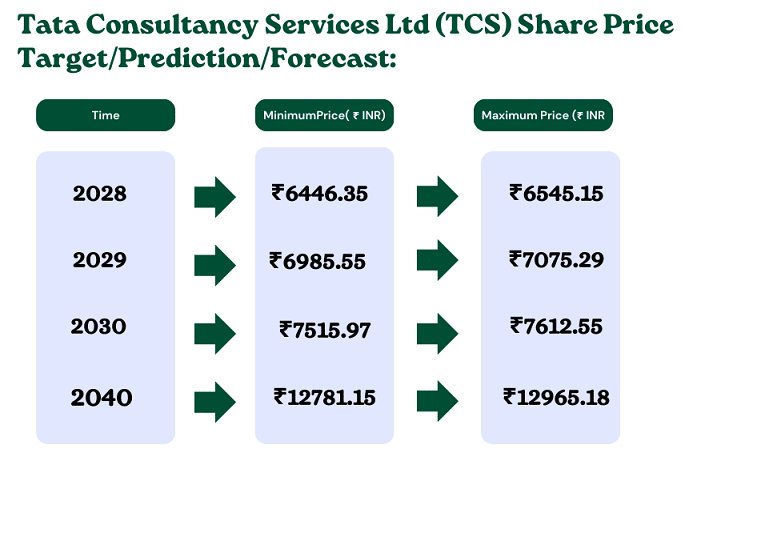

Tata Consultancy Services Ltd (TCS) Share Price Target/Prediction/Forecast:

Over the last two decades, TCS has consistently demonstrated impressive growth, boasting a remarkable compound annual growth rate (CAGR) of 15%. With the increasing demand for digital transformation services, the company is poised for further success.

Based on a recent Bloomberg survey of analysts, the average 10-year price projection for TCS stands at ₹6,500. This projection suggests a potential return of approximately 70% from the current price, underscoring the company’s promising outlook.

What is TCS’s position in the IT industry and among Indian companies?

TCS ranks as the second-largest Indian company by market capitalization and is highly regarded as a valuable IT service brand worldwide.

Who is the Current CEO and Managing Director of TCS?

K. Krithivasan holds the position of Chief Executive Officer and Managing Director at TCS.

How has TCS’s share price grown over the years?

TCS has demonstrated consistent share price growth with a compound annual growth rate (CAGR) of 15% over the past two decades.

What is the outlook for TCS’s share price in the next 10 years?

Analysts project a 10-year price target for TCS at an average of ₹6,000, suggesting a potential return of approximately 70% from the current price.

What is the dividend policy of TCS?

TCS’s board of directors has approved an interim dividend of Rs 9 per share for the quarter, indicating a commitment to rewarding shareholders.

[…] Also Read- TCS Growth and Innovation in the IT World […]