In this blog, we’re talking about what might happen to Adani Enterprises’ stocks in the next six years, until 2030. We’re exploring Adani Enterprises’ past and present stock performance and anticipating his growth. From historical ups and downs to current challenges and opportunities, let’s take a quick tour of what could shape the company’s stock journey in the next decade.

Adani Enterprises Limited, founded by Gautam Adani in 1988, is a dynamic Indian conglomerate operating in diverse sectors. With a strong presence in energy, resources, logistics, and agri-infrastructure, the company has achieved significant financial growth and market capitalization. Notably, Adani Ports and Special Economic Zone (APSEZ) stands out as a major player in India’s port operations.

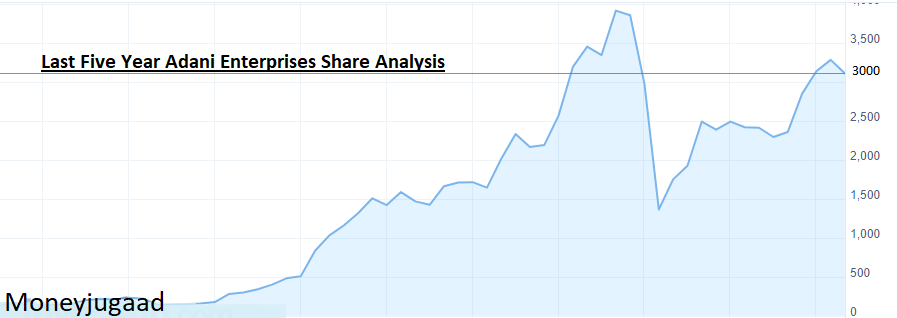

Adani Enterprises Historical Yearly Growth and Analysis:

Adani Enterprises has experienced a Compound Annual Growth Rate (CAGR) of 27.3% for its profits over the past five years. This means that on average, the company’s profits have grown by 27.3% annually over this period. CAGR is a useful measure because it smoothens out the fluctuations that may occur from year to year, giving a clearer picture of the overall growth trend. In the case of Adani Enterprises, a CAGR of 27.3% indicates a strong and consistent growth in profits over the specified time frame.

Over the past year, the share price has surged by a significant 99.46%, compared to a 22.87% gain in the Nifty index. Here is analysis of last five year company overview-

Adani Enterprises Ltd (ADEL) Share Price expected growth in upcoming months:

Analyst estimates for Adani Enterprises’ share price in the future vary widely, ranging from moderate growth to further downturns, reflecting the uncertainty surrounding the company. Predicting how well Adani Enterprises’ stocks will do in the next year is tricky because things are really uncertain right now. There are some serious issues and investigations happening, making it hard for experts to agree on what might happen. So, if you hear different predictions, just know that they come with a big warning to take them cautiously.

Here’s some analyst targets for Adani Enterprises share price in 2024:

| Analyst/Firm | Target Price (₹) | Base Case/Scenario |

|---|---|---|

| CLSA | 3,500 | Positive resolution to allegations, strong company performance, bullish market |

| Motilal Oswal | 3,000 | Positive resolution to allegations, moderate growth, neutral market |

Adani Enterprises Ltd (ADEL) Share Price Target In 2024,2025, 2027,2029, 2030

| Year | Target Share Price (₹) |

|---|---|

| 2024 | 3,513.22 |

| 2025 | 4,095.67 |

| 2027 | 7,007.24 |

| 2029 | 9,260.56 |

| 2030 | 12,133.82 |

Top Investors in Adani Enterprises Ltd:

| Investor Category | Country | Stock % | Notable Investors |

|---|---|---|---|

| Promoters | India | 50.29 | Adani Family entities (Green Enterprises Investment Holding RSC Ltd., Flourishing Trade & Investment Ltd., Kempas Trade & Investment Ltd., Afro Asia Trade & Investments Ltd., Worldwide Emerging Market Holding Ltd.) |

| Mutual Funds | Various | 1.39 | Spread across various schemes from different fund houses |

| Foreign Institutional Investors (FIIs) | Various | 14.52 |

Also Read – 2024-2030 : Adani Green Energy Share Price Target and Long-Term Vision (2040-2050)

Here’s a table that includes the countries, their stock percentages:

| Country | Stock % | Notable Investors |

|---|---|---|

| United States | 5.23 | BlackRock Inc., Capital Research & Management Company (CRMC), The Vanguard Group, Inc. |

| United Kingdom | 1.54 | Aberdeen Standard Investments, Baillie Gifford |

| Singapore | 1.27 | Temasek Holdings |

| Abu Dhabi | 1.04 | Abu Dhabi Investment Authority (ADIA) |

| Other | 5.44 |

Adani Enterprises Ltd releases his IPO in 1994

Back in 1994, a young guy named Gautam Adani, who had dropped out of college and was working with commodities, did something pretty bold. He started Adani Enterprises and let people buy shares in the company, known as an initial public offering (IPO). Even though he wasn’t a big shot at the time, he saw a huge chance in India’s growing economy and the need for more infrastructure. People loved the idea, and they bought shares for just ₹10 each, bringing in a solid ₹12.5 crore. This money was like rocket fuel for Adani’s big plans, taking him from doing stuff with ports and power plants to mining and green energy. Basically, he went from being a small-time player in one area to a big deal across the whole country.